$402,302

$341,956

$8,836.68

Ummm, ok, what are those numbers? Those are numbers I think you will be quite interested in…

$402,302 is the average sales price in Denver right now.

$341,956 would be the mortgage amount with an average down payment (15%).

$8,836.68 is the extra interest paid over 30 years between a 3.875% rate and a 4% rate.

I don’t know about you but $8,000, nearly $9,000 is a lot of money! If I could shop around to different mortgage companies and find a rate that is just .125% lower and save that much money, why wouldn’t I?! Well, I think you should. But it isn’t that easy. Let me explain so you can find the best mortgage lender for you…

What are You Shopping For?

Simple, right? Maybe not. Think about this for a moment. What are you really shopping for when you “shop” for a mortgage?

Are you shopping for the best rate?

Maybe the lowest closing costs?

Does service play into your decision at all?

How about the best mortgage loan product?

Is convenience important?

Not so simple. When you boil it all down I think what you are really shopping for is peace of mind. You want the peace of mind that you got the right product for YOU. Does a low rate play into that? Of course. Low closing costs – yep! All of it is important in some way shape or form. So, now that we know what we are really shopping for let’s get going!

STEP 1: Where to Shop?

If you needed to buy a computer where would you go? My guess is you already know a store that sells computers near you. Maybe you would go back to the store who sold you your last computer. You could ask a friend or you could Google computer stores and find the one closest to you. There are many options but my guess is that you wouldn’t spend too much time thinking about where to go…you would probably hop in the car and go.

How about getting a mortgage? Where do you start?

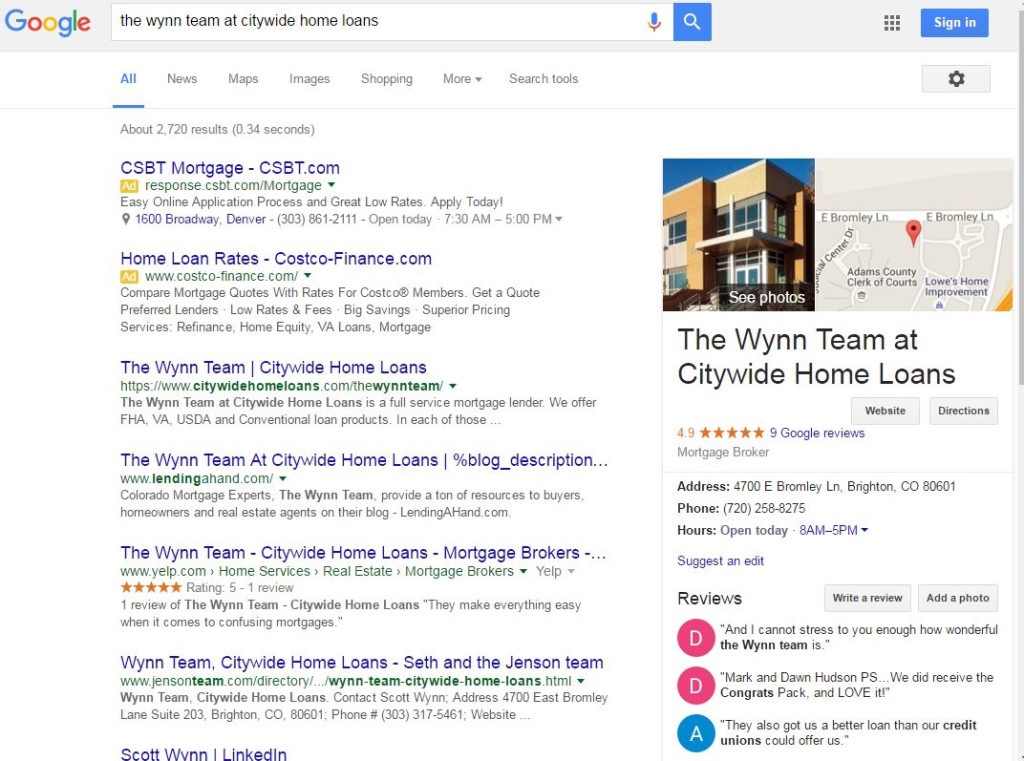

I would start with a referral. Do you know someone you trust (maybe a real estate agent or family member) that might know a mortgage lender they could refer you to? If so, start there…but don’t stop there. Take the person they referred you to and Google their name. Here is an example:

Normally when you search a business there will be ratings of some kind – either through Google or other sites, like Yelp. On the right hand side Google has a 4.9 star rating with 9 reviews with excerpts right below the business details. Within the actual search results there is a Yelp page with a 5 star rating, as well. The Wynn Team at Citywide Home Loans must be pretty good, huh?

Another search result is of another company who recommends the Wynn Team enough they were willing to add their info onto their website.

The point in Googling the person recommended to you is to see if they have a good reputation or if you need to find someone else. If nothing shows up in Google I would continue to look for someone else…but, hey, that’s me.

Let’s say you couldn’t find a recommendation or your Google results didn’t look good. Turn to Google once again. Google something that pertains to your situation. For example, are you looking for a down payment assistance program? Search for that. Qualify for a VA loan? Search for that. Whatever your situation is do a quick search.

Once you get the results find a website that is providing information…not trying to sell you, but real, helpful information. Read what they have to say. Are they a mortgage lender? Give them a call.

If all else fails, try websites like Zillow or Trulia for highly rated mortgage professionals you can call to discuss what they offer.

STEP 2: What to Ask When You Shop?

STEP 2: What to Ask When You Shop?

Before you can even ask a question you have to reach someone and that is the first test. Call each of the lenders during normal business hours – 8am – 5pm Monday-Friday. Did they answer the phone? Did you have to leave a message? If so, how quickly did they return your call. Consider this – if it is hard for you to reach someone when you are trying to become a customer just imagine how difficult it might be to reach them when you are their customer. It probably won’t be much different.

Alright, you’ve got a lender on the phone, what should you ask? Exactly! Huh?! You don’t know. You shouldn’t have to know.

The lender should be the professional guiding you through what you should do and explain the steps necessary to get qualified and into the best loan package. Call them up and simply say, “Hi, I am looking to get a mortgage and I’m hoping you could help me out.” That simple.

Then, just listen. What questions do they ask? What information do they give you? How comfortable do you feel? I believe that most people have very good intuition – you know, that gut feeling. More than anything, tap into your gut and listen to what it is saying. If things feel right, continue. If not, keep looking.

STEP 3: Narrowing it Down

Let’s say you have narrowed the options down to 2-3 lenders to work with. They have passed your Google test and the gut feeling test and now you need to get down to business…not all the foo foo stuff. This is where it starts to get tricky.

You are going to need to start the loan application process. To be fair and to get the best outcome, you will need to do this with all the lenders you are comparing.

I would encourage you to tell the lenders that you are comparing. Be up-front and allow them to share with you why they believe working with them is the best choice.

Once the application or up-front worksheet (whatever they call it) has been completed ask each lender based on the information you provided (credit score, debt-to-income ratio and money available for down payment) and ask their advice. What do they recommend? FHA, Conventional? How much should you put down? Is there mortgage insurance? Any special programs you qualify for?

Reassess how you feel. Are you serious? We are back to this foo foo stuff again?! Yep…I think that your gut tells you way more than a spreadsheet comparing every dollar, cent and percentage. Do you need to eliminate someone from the running?

STEP 4: Apples to Apples

STEP 4: Apples to Apples

You’ve got at least a couple of lenders’ recommendations. Which one sounds the best to you? Whichever one you pick have both lenders quote that recommended loan structure the exact same way, at the exact same time.

They should be able to provide you with some sort of worksheet that breaks down the loan program, loan amount, interest rate, payment (in all its parts – insurance, taxes, MI, HOA, etc.) and closing costs.

Make sure the purchase price, loan amount, interest rate and payment all MATCH. For the comparison to work right they must match even if the rates they quoted are different, have one of them adjust their rate and closing costs to match the other (they can do this).

Make sure that you get the estimate worksheets within 1-2 hours of each other to avoid market conditions from playing into your decision. Remember when you first tried to reach the lenders? Did it take a while to get a return call? If you kept someone like that in the running, this is where that will become a problem.

Here is where your handy spreadsheet finally comes into play. Since everything except closing costs are now exactly the same you can compare apples to apples. Go through every line item on the estimate worksheets and compare the fees being charged. Focus on the fees charged by the lender: Fees such as origination fee, discount charge, processing, underwriting, admin, doc prep, appraisal.

The other fees are important but will end up being the same independent of the lender you choose to work with. Fees such as title insurance, recording fees, prepaid interest, escrow account (taxes and insurance) are fees not charged by your lender so they should not be used in the comparison.

STEP 5: The Final Selection

Which lender came out less expensive on the fee comparison? With the payment equal the fees will tell you which lender will be better financially.

How do you feel? Is the lender with the lower costs the lender you were hoping was less expensive? Many times you have a gut feeling about the lenders you are comparing without realizing it until the very end. When the end result based on the money does not align with who you wanted to work with. If this happens, realize it and do something about it.

How far off is it? Is it less than $500 or $1,000? Is it worth paying a slight premium to go with the lender you feel is best? My guess is that it is, but only you can decide. Let’s say the lender you wanted to work with is more expensive. Give them a call.

They already know you were comparing them, right? Tell them you did the comparison and they came out higher but that you want to work with them. Tell them how much difference there was and see if they can adjust anything to bring the cost down. Whatever their answer is, it is time for you to make a decision.

Keep in mind we did not get to the financial comparison until the very end. That was intentional. The financial piece of shopping for a mortgage lender is the most insignificant part.

If you can get a really low rate at a really low cost but the lender doesn’t give you the right loan program, did it matter?

If you can get an amazing rate on the right loan program but they don’t return your calls, did it matter?

If you can work with a loan officer you really connect with and they offer a pretty good rate but they didn’t even know about a particular loan product that existed for your situation, did it matter?

If you can work with a loan officer you really connect with and they offer a pretty good rate but they didn’t even know about a particular loan product that existed for your situation, did it matter?

Maybe you noticed or maybe you didn’t but I have not been talking about the best rate, the lowest closing costs, the type of loan, etc. I have been referring to the best loan package. The loan package refers to the whole shebang – rate, closing costs, loan product, AND service, communication, expertise.

My hope is that this guide has provided you with the road map to choosing the right lender for you. If you are looking to buy or refinance in the State of Colorado, I would love to be one of the lenders you consider. Contact me if you would allow me the opportunity to assist you.

Hello my husband John Jablonski and I are wanting to buy a home. We are first time home buyers and would like to know what we need to do to get started.

Ashley – we would love to asssist you and John. Can you give me a call so we can discuss your situation and advise you on next steps and various options? 303-317-5461.